As the digital economy continues to evolve, Cyprus has positioned itself as a leading jurisdiction in Europe for entrepreneurs and businesses entering the crypto space. The process of obtaining a crypto license in Cyprus may seem complex, but with the support of experienced professionals, it can be a streamlined and lucrative venture. In this article, we'll delve into the key advantages, requirements, and steps involved in obtaining a crypto license in Cyprus.

Registration and Licensing Requirements

The cornerstone of cryptocurrency regulation in Cyprus is the Prevention and Suppression of Money Laundering and Terrorist Financing Law of 2007 (AML/CFT Law). Enforced by the Cyprus Securities and Exchange Commission (CySEC), this legislation oversees the compliance of crypto asset service providers (CASPs) with AML/CFT regulations, reflecting the commitment to financial integrity and security.

CySEC, as the supervisory authority, not only enforces regulations but also drives innovation through the Innovation Hub. This initiative plays a pivotal role in the development of Cyprus's financial ecosystem by providing guidance on regulatory compliance. Moreover, it serves as a platform for open dialogue, facilitating a better understanding of market concerns and ideas expressed by participants.

Cyprus offers three distinct types of crypto licenses, each categorized based on specific capital requirements:

Type 1

This license is granted to Crypto Asset Service Providers (CASPs) primarily engaged in financial advisory services. The mandated authorized capital for this type is €50,000.

Type 2

Designed for CASPs with a broader spectrum of activities that permits the provision of consultations and various financial services. These services include:

- accepting applications,

- executing client orders,

- converting cryptocurrencies,

- exchanging between different crypto-assets,

- participating in cryptocurrency-related financial transactions,

- risk-free placement of crypto-assets,

- investment portfolio management.

The required authorized capital for Type 2 licenses is €125,000.

Type 3

Tailored for CASPs offering a comprehensive range of financial services that covers both Type 1 and Type 2 services. Additionally, they include:

- administration, transfer of ownership, transfer of site, holding, and/or safekeeping, including custody, of crypto-assets or cryptographic keys or means enabling control over crypto-assets,

- underwriting and/or placement of crypto-assets with firm commitment,

- operation of a multilateral system, which brings together multiple third-party buying and selling interests in crypto-assets in a way that results in a transaction.

The stipulated authorized capital for Type 3 licenses is €150,000.

These license types allow businesses to choose the one that best aligns with their intended activities, with the associated authorized capital serving as a key determinant. It is crucial for businesses to assess their specific needs and objectives before selecting the appropriate license type for their operations in Cyprus.

Registration Fees

CySec registration charges are as follows:

- €10.000 for the examination of an application. Successful applicants will not be required to pay an additional fee for the first year of their registration.

- €5.000 for the purposes of renewal of registration per year.

CySEC Relationship with MiCAR

In light of the evolving trends in the crypto-asset sector, CySEC advocates for EU-wide regulation. The EU Regulation on Markets in Crypto-Assets (MiCA) aims to establish regulatory requirements for the public offer and marketing of crypto-assets, as well as the provision of services related to them. MiCA is designed to bring crypto-assets, issuers, and service providers under a unified regulatory framework to protect investors, ensure financial stability, and foster innovation.

CySEC recognizes the technical and operational risks in the crypto-asset market, including cyberattacks and failures of IT and blockchain infrastructures. The complexity of blockchain systems and innovative business models, combined with a lack of information and the intangible nature of digital assets, heightens the risk of fraud. Investors are reminded that the capital invested in crypto-assets is not guaranteed, and there is always a risk of partial or total loss.

CySEC's proactive approach to investor education aligns with the impending MiCA regulation. The regulator is determined to contribute to the improvement of investor awareness and understanding of crypto-asset risks. As MiCA progresses, CySEC is poised to play a crucial role in its comprehensive supervision, safeguarding investor interests and promoting financial literacy in Cyprus and beyond.

Steps in the Licensing Process

Obtaining a cryptocurrency license in Cyprus involves several key steps:

- Familiarize with CySEC Requirements: Study all formal requirements and CySEC guidelines for license applicants, ensuring a comprehensive understanding of the regulatory landscape.

- Prepare Corporate Documents: Gather all necessary corporate documents, ensure compliance with Cypriot law, and translate them into English or Greek.

- Develop Guidelines: Create detailed anti-money laundering guidelines and measures, consulting with experts to draft effective and competent manuals.

- Complete and Pay for the Application Form: Fill in the application form, check all details, and pay the required fee for the Crypto License in Cyprus.

- Sending Documents to CySEC: Utilize the required forms and questionnaires from the official CySEC website for correct processing.

- Waiting for a Decision: As CySEC may consider the application for up to six months. Staying in touch and being prepared to provide additional information if needed is crucial in this stage.

Requirements for CASPS Registration

The process for establishing a Corporate and Service Provider Structure (CASPS) in Cyprus involves several key steps:

- Company Registration and Office Space: Register the company in Cyprus and secure a fully-fledged office and staff.

- Evaluate Participants' Reputation: Conduct thorough evaluations of all participants, from beneficiaries to service providers, ensuring a reputable and reliable network.

- Formalize Reports and Policies: Pay particular attention to formalizing beneficiary reports and corporate policies, reflecting transparency and compliance.

- Complete Application Forms: Neatly complete all questionnaires and forms required for the application, ensuring accuracy and completeness.

- Choose the CASP License Class: Ensure that the chosen CASP license class meets the capital requirements, aligning with the scope of services offered.

- Follow KYC Procedures: Strictly follow customer identification procedures (KYC), assessing associated risks and implementing effective risk management strategies.

- Develop Internal Policies: Have clearly defined internal policies and procedures to prevent potential conflicts of interest with clients, ensuring ethical business practices.

- Documentation Preparation and Submission: Prepare all necessary documentation, and submit the application package to the Cyprus Registrar of Companies for review. The final decision is typically made within one to two months.

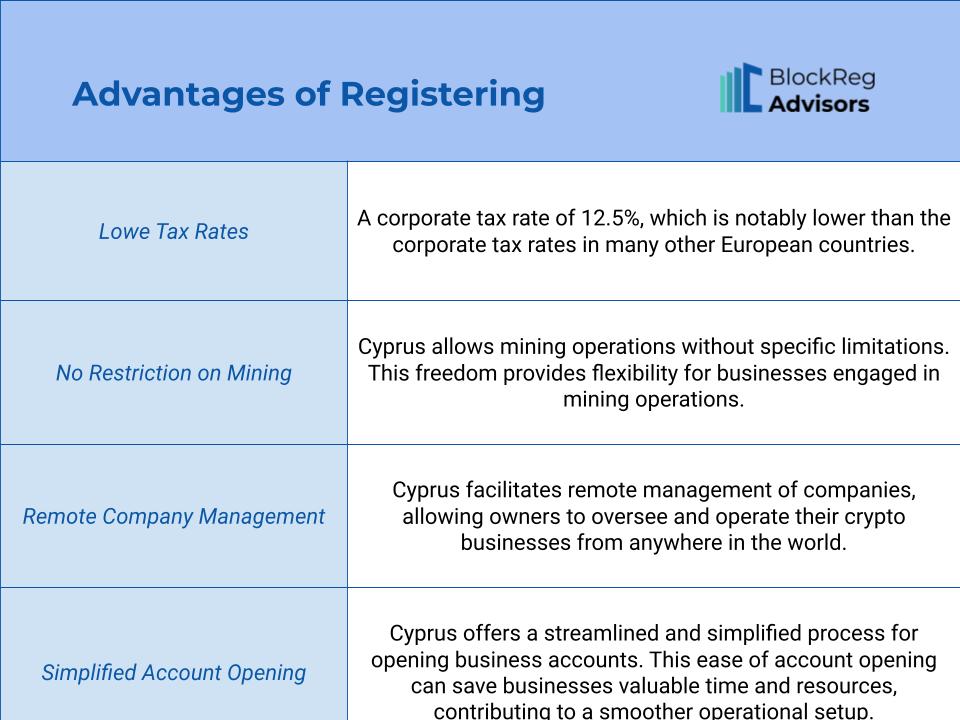

Taxation of Crypto Activities

Crypto enterprises operating in Cyprus are subject to the same tax obligations as other businesses. However, what sets Cyprus apart is its attractive corporate income tax rate, standing at a mere 12.5%. This rate is notably lower than the average corporate tax rates in many European countries and places Cyprus among the EU members with the most favorable tax environments.

The tax system in Cyprus is designed to encourage both local and foreign businesses to thrive. Companies that establish tax residency in Cyprus—either through incorporation or registration—are required to pay taxes on their income, irrespective of its origin. This taxation approach is provisional and relies on self-assessment, providing flexibility for companies to review and adjust their tax evaluations until December 31 of the relevant tax year.

Payment intervals for corporate income taxes occur semi-annually, with deadlines on July 31 and December 31. This system enables businesses to manage their financial obligations efficiently. Additionally, Cyprus stands out for its commitment to transparency and fairness, as companies have the opportunity to rectify overpaid taxes, while any outstanding tax debts incur a modest annual interest rate of 3.5%.

Beyond the appealing corporate income tax rate, Cyprus offers crypto companies the advantage of more than 65 double taxation agreements with various countries. This extensive network of agreements facilitates international business operations by preventing the same income from being taxed in multiple jurisdictions.

Why Should Companies Consider Registering in Cyprus?

In the expanding world of crypto businesses, Cyprus, with its unique blend of strategic advantages and a welcoming regulatory environment, stands out as an ideal destination for companies in the crypto space .Beyond the mentioned key advantages of registration, there remain numerous crucial reasons why companies should contemplate establishing themselves in Cyprus:

EU Access and Passporting: As an EU member state, Cyprus provides businesses with a gateway to the broader European market. Through passporting rights, companies can seamlessly offer their services across EU member countries, eliminating the need for additional licenses. This facilitates streamlined market expansion and accelerates business growth.

Strategic Geographical Location: Situated at the crossroads of Europe, Asia, and Africa, Cyprus offers a strategic advantage for crypto businesses with global operations. Its central location enables companies to tap into multiple markets and time zones, fostering international reach and market accessibility.

Robust Legal Framework: Cyprus boasts a well-established legal framework that provides clear guidelines for crypto companies. This regulatory stability not only ensures a secure operating environment but also cultivates trust among investors and stakeholders, contributing to long-term business sustainability.

Access to Banking Services: Acquiring a Cyprus crypto exchange license grants businesses access to banking services within the country. This access proves advantageous for settling payments and conducting financial transactions, enhancing the overall operational business efficiency.

Vibrant Crypto Ecosystem: Cyprus is home to a thriving ecosystem of crypto communities, traders, brokers, and financial experts. Regular specialized events and forums attract global professionals, creating ample opportunities for networking, collaboration, and staying abreast of industry trends.

Navigating the regulatory landscape in Cyprus, while aiming for robust oversight, reveals a notable aspect of adaptability that can present challenges for businesses in the crypto sector. For instance, the absence of specific regulations concerning cryptocurrency mining may initially seem like a hurdle. However, with the guidance of experienced consultants, businesses can effectively overcome these regulatory uncertainties, ensuring a smooth operational flow.

Conclusion

In conclusion, Cyprus emerges as a crypto-friendly ecosystem, providing a conducive environment for businesses to thrive. To navigate the complexities of licensing and registration in Cyprus, it's crucial to stay informed and seek guidance from professionals. BlockReg Advisors, with their expertise in crypto regulatory consulting services, can be a strategic partner in ensuring a seamless and successful registration process. By collaborating with experienced professionals, a wide range of benefits can be realized, safeguarding the company's reputation, financial stability, and cybersecurity. This partnership positions the company for success in the dynamic and rapidly evolving digital assets market.

If you want to discuss these topics further do not hesitate in contacting our team at [email protected] and [email protected].