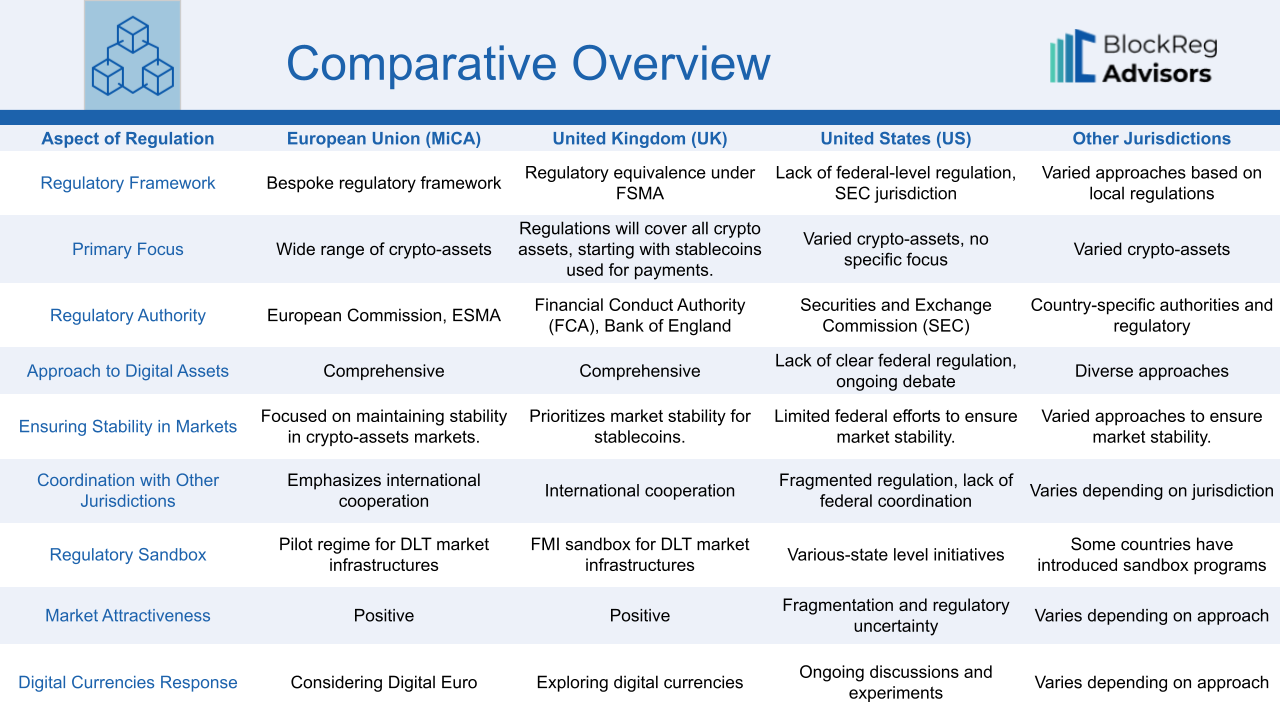

The regulation of crypto-assets has become a prominent issue on the international financial stage, with various jurisdictions taking distinct approaches to address the challenges and opportunities presented by these digital assets. This article presents insights into the evolving regulatory landscape of crypto-assets, drawing from the comprehensive research conducted by the European Parliamentary Research Service. The research, titled "Non-EU countries' regulations on crypto-assets and their potential implications for the EU" examines regulatory approaches in various jurisdictions, including the European Union (EU), the United Kingdom (UK), the United States (US), and other relevant regions such as Japan.

European Union (MiCA)

In the EU, the Markets in Crypto-assets Act (MiCA) is a comprehensive regulatory framework adopted in June 2023. MiCA focuses primarily on stablecoins, which are crypto-assets promising stable value against official currencies or a basket of currencies. The regulation aims to harmonize the fragmented regulatory landscape, protect consumers and investors, and promote the development of EU-based digital ledger technology (DLT) infrastructure.

Key Aspects of MiCA:

- Regulatory Framework: Bespoke regulatory framework for crypto-assets.

- Primary Focus: Stablecoins, crypto assets, asset referenced tokens, and all services related to these.

- Regulatory Authority: European Commission and European Securities and Markets Authority (ESMA).

- Approach to Digital Assets: Comprehensive regulation.

- Coordination with Other Jurisdictions: Emphasizes international cooperation.

- Financial Stability Concerns: Addressed.

- Market Attractiveness: Positive.

- Digital Currencies Response: Considering Digital Euro.

United Kingdom (UK)

The UK has shown a commitment to becoming a global crypto hub, with the Financial Services and Markets Act (FSMA) amended in June 2023 to address crypto-assets. The UK's regulatory approach treats crypto-assets equivalently to other financial instruments, emphasizing effective regulation to boost innovation and investor confidence.

Key Aspects of UK Regulations:

- Regulatory Framework: Regulatory equivalence under FSMA.

- Primary Focus: All crypto assets are capable of being captured under financial services regulations, stablecoins used as a means of payment will be addressed first.

- Regulatory Authority: HM Treasury, Financial Conduct Authority (FCA), Bank of England, Prudential Regulation Authority (PRA)

- Approach to Digital Assets: Comprehensive regulation.

- Coordination with Other Jurisdictions: International cooperation.

- Financial Stability Concerns: Addressed.

- Market Attractiveness: Positive.

- Digital Currencies Response: Exploring digital currencies.

United States (US)

The US has yet to implement comprehensive federal-level regulation for crypto-assets, resulting in regulatory and supervisory ambiguities. The Securities and Exchange Commission (SEC) plays a key role, but the approach to classifying crypto-assets varies. Recent legislative efforts aim to clarify the regulatory framework, especially for stablecoins.

Key Aspects of US Regulations:

- Regulatory Framework: Lack of clear federal regulation, ongoing debate.

- Primary Focus: Varied crypto-assets, ongoing debate.

- Regulatory Authority: Securities and Exchange Commission (SEC).

- Approach to Digital Assets: Lack of clear federal regulation.

- Coordination with Other Jurisdictions: Fragmented regulation, lack of federal coordination.

- Financial Stability Concerns: Ongoing concerns and uncertainty.

- Market Attractiveness: Fragmentation and regulatory uncertainty.

- Digital Currencies Response: Ongoing discussions and experiments.

Other Jurisdictions: Comparative Table of Regulations

Numerous countries have adopted diverse approaches to regulating crypto-assets. Notable among them is Japan, which has implemented a stringent regulatory framework focused on investor protection and anti-money laundering measures. Other jurisdictions follow their unique regulatory paths, reflecting the global diversity in crypto-asset regulation.

This comparative analysis highlights the diversity in regulatory approaches to crypto-assets across different jurisdictions. While some regions have adopted comprehensive frameworks, others are still in the process of defining their regulatory path. International cooperation remains crucial to address potential challenges and ensure a level playing field in the evolving crypto-asset landscape.

International Coordination and Its Impact on the EU

Cooperation between countries on regulating crypto-assets is becoming increasingly important. These digital assets don't stick to one country's rules, so global rules are needed. Here's what's happening and what it means for the European Union (EU).

Global Standards: A group called the International Organisation of Securities Commissions (IOSCO) is developing rules for crypto-assets. They issued 18 rules in May 2023. These rules cover areas such as conflicts of interest, market manipulation, cross-border risks, custody protection, operational and technological risk, and retail access.

G7 and Digital Currencies: The Group of Seven (G7) has primarily focused on digital currencies in its regulatory discussions. In October 2021, the G7 recognized the importance of strong international coordination and cooperation to promote innovation and cross-border benefits. It expressed a shared commitment to regulate crypto-assets, especially stablecoins. The G7 also outlined public policy principles for digital currencies, emphasizing foundational issues and opportunities.

Regulatory Tricks highlighted by Bank of International Settlements (BIS): The organization has underlined the inherent potential for regulatory and supervisory arbitrage in the crypto-asset space. Due to their cross-border nature, crypto-assets can be subject to different regulatory environments, creating challenges for international consistency.

Implications for the EU: While the EU has renewed its efforts to regulate crypto-assets comprehensively, challenges remain. The EU's regulatory actions, combined with those of third parties, contribute to assertive, comprehensive, and unified regulation. However, the EU's financial system still faces risks due to dependencies on non-EU countries' policy actions, especially concerning the Markets in Crypto-Assets (MiCA) framework.

Financial Stability Concerns: EPRS research highlights that non-EU countries' current crypto-asset regulations raise concerns about financial stability due to potential price volatility and shocks in crypto-asset markets. The collaboration of global financial systems and decentralized crypto-assets underline the need for regulatory alignment among key jurisdictions. The article gives an example of a paper written by the European Central Bank's Crypto-Assets Task Force that warns of financial stability risks, including liquidity runs and contagion effects, associated with the widespread use of stablecoins. The International Monetary Fund, mentioned in the same commentary, has also observed increasing spill-overs between crypto and equity markets, emphasizing the importance of coordinated global regulation to prevent systemic risks.

Spreading Problems: Publication indicates that the unpredictable changes in stablecoin prices can affect traditional markets. This connection between crypto-assets and regulated financial systems creates major risks for the whole system. When countries don't coordinate their rules, it can make money move in ways that create instability.

Crypto Market Attractiveness: Regulatory approaches influence issuers' decisions to issue and trade crypto-assets. Issuers may prefer jurisdictions with lenient regulations or those with broader investor bases due to protective standards. Research analyses reveal that regulatory actions impact market prices and market activity, emphasizing the importance of regulated financial institutions and national regulation.

In summary, international coordination in crypto-asset regulation is vital to address the global nature of these assets. The EU's efforts to regulate comprehensively must consider potential risks and dependencies on non-EU countries' policies. Ensuring financial stability, mitigating systemic risks, and creating an attractive business environment are essential in this evolving landscape.

Conclusion

The global regulatory landscape for crypto-assets is a patchwork of approaches. The EU's MiCA represents a comprehensive attempt to regulate crypto-assets, with a focus on stablecoins. The UK aims to become a crypto hub with a balanced regulatory framework. In the US, regulatory ambiguity persists, and legislative efforts are underway.

Other jurisdictions take varied approaches, reflecting the complexity of the crypto landscape. International cooperation is essential to address financial stability risks and ensure a level playing field.

The future of crypto regulation will balance innovation and investor protection. As digital currencies and stablecoins gain prominence, regulations will continue to adapt to this evolving financial landscape.