For many, the term "white paper" is synonymous with the world of cryptocurrencies and blockchain technology. Whether you are a seasoned investor, a technology enthusiast or a crypto business owner, understanding the essence, significance and regulatory requirements of a white paper is vital. This article serves as a beginner's guide to deciphering what a white paper is, why it matters in the crypto space, what are the regulatory requirements and some essential steps to writing one.

What is a White Paper?

White papers have initially been used to disseminate information regarding key decisions made by specific government bodies. Over time, white papers have evolved and are now used extensively in both the public and private sectors, demonstrating their versatile application in today's landscape, as a marketing, thought leadership and inception tool used to persuade and influence decision-makers.

In the context of cryptocurrency, a white paper is a comprehensive document that explains the technical aspects, purpose and vision of a blockchain-based project or digital asset. Think of it as a detailed blueprint that outlines the problem the project aims to solve, the proposed solution, the underlying technology and the potential benefits to investors and users.

Why are White Papers Important?

Educational Tool: White papers serve as educational resources, helping investors and stakeholders understand the project's technology and vision.

Investor Confidence: Investors often use white papers as a primary source of information before investing in a project. A well-crafted white paper can build confidence and trust.

Regulatory Compliance: A white paper also plays a crucial role in navigating the regulatory landscape, ensuring that the project complies with relevant laws and regulations.

Key Concepts of a White Paper

Regulatory requirements - Market in Crypto Assets Regulation

The EU Markets in Crypto-Assets (MiCA) Regulation which entered into force in June 2023 and will apply as of June/ December 2024, is a comprehensive framework governing centralized crypto-related businesses across its 27 member-states. This regulation introduces licensing requirements and mandates several obligations for businesses that issue crypto assets or EMT/ARTs and/ or provide crypto assets services to EU customers. It aims to enhance investor protection, market integrity and facilitate the growth of the digital asset sector within the EU.

MiCAR has introduced new regulatory requirements for crypto assets white papers, mandating a comprehensive disclosure of essential information about the crypto assets being offered or admitted to trading. This includes detailed descriptions of:

- The issuer.

- The crypto asset itself.

- The offer or admission to trading.

- The rights and obligations attached to the crypto asset.

- The underlying technology.

- The risks involved.

In addition, the white paper must include information on:

- The adverse environmental and climate-related impacts of the consensus mechanism used to issue the crypto assets, aligning with increasing emphasis on sustainability and green energy in the digital assets space.

The white paper must be:

- Published in one of the official languages of an EU member state or a customary. language in international finance, ensuring accessibility and transparency.

- Provide clear and non-misleading information.

- Any related marketing communications must be consistent with the white paper.

Notably, while a prospectus requires regulatory approval before publication, no such authorization is needed for a white paper. However, the relevant competent authority must be notified and the white paper must be made available to potential buyers, promoting a culture of investor protection and transparency.

The competent authority of the home Member State must promptly notify the European Securities and Markets Authority (ESMA) of the crypto assets white paper and any changes to the starting date of the public offer or admission to trading. ESMA is then responsible for making the white paper available in the register by the start of the offer or trading.

Should the alterations impact payment systems, monetary policy or monetary sovereignty, regulatory bodies may engage with the European Central Bank, national central banks, European Banking Authority (EBA) and the ESMA for guidance. The validation of the revised white paper might involve prerequisites aimed at safeguarding token holders and addressing concerns related to market integrity or financial stability.

Additionally, offerors, persons seeking admission to trading or operators of trading platforms for crypto assets, other than asset-referenced tokens or e-money tokens, must notify their white papers to their home Member State's competent authority. They must also notify marketing communications to both the home and host Member States' competent authorities when targeting prospective holders of crypto assets, other than asset-referenced tokens or e-money tokens, in those Member States. This notification should include an explanation of why the crypto assets should not be considered excluded from the scope of MiCAR, an e-money token, or an asset-referenced token.

Notification period for specific crypto assets white paper:

- For all crypto assets other than asset referenced tokens and e-money tokens the notification period of the competent authority of their home member state is no less than 20 working days before the publication of the white paper. The competent authority shall notify ESMA within the 5 working days of the receipt.

Publication of the specific crypto assets white paper:

- For issuers who impose a deadline for their public offering, they are obligated to share the outcome of the offer on their site within 20 working days post the subscription deadline. As for those without a set deadline, they must periodically publish, at a minimum, monthly, the quantity of crypto-assets currently in circulation on their website.

- In the particular scenario involving asset-referenced and e-money tokens, the party issuing these tokens is required to not only post the authorized crypto assets white paper on its site but also any revised white papers. The accepted white paper should be made accessible to the public before trading or offering of the token commences. Subsequently, both the approved and modified white papers should be maintained on the issuer's website as long as the public holds the crypto-asset.

Modification period for specific crypto assets white paper:

1. Crypto assets other than asset-referenced tokens or e-money tokens:

- These crypto-assets, excluding asset-referenced tokens or e-money tokens, must undergo modifications to their published white papers if significant new factors, material mistakes or material inaccuracies that could impact the assessment of the crypto assets are identified. Such alterations are relevant throughout the period of public offering or while the crypto assets are being traded.

- Competent authorities must be notified of these modifications at least seven working days before publication, with an accompanying explanation of the reasons behind the changes. On the publication date or an earlier date if required by the competent authority, the party responsible for the crypto assets white paper must immediately inform the public on their website about the modified white paper.

- Additionally, within five working days, the competent authority must notify the host member states and inform the ESMA about the modified crypto assets white paper. These modified versions of the white paper must be published on the website, time-stamped and marked as applicable.

- All modified versions must be available for as long as the public holds the crypto assets. Alterations to utility token offers should not extend the 12-month time limit. Older versions should remain accessible on the website for ten years, marked as invalid with a warning and a link to the latest version.

2. Asset-referenced tokens:

- For asset-referenced tokens, the issuer must communicate any significant changes to their business model that could significantly influence the purchase decisions of existing or potential token holders. These modifications include alterations in governance arrangements, reserve assets, token rights, issuance and redemption mechanisms, transaction validation protocols, distributed ledger technology, liquidity management, third-party arrangements, complaints-handling procedures, and anti-money laundering policies. Notification must be made 30 working days before the changes come into effect.

- Subsequently, the issuer must prepare a draft modified crypto-asset white paper consistent with the original and submit it to the competent authority of its member state for approval. The authority must acknowledge receipt within five working days and endorse or reject it within 30 working days.

- In instances where the modifications impact payment systems, monetary policy, or monetary sovereignty, the competent authority may consult the European Central Bank, national central banks, the European Banking Authority (EBA), and the ESMA. The approval of the modified white paper may entail requirements to safeguard token holders and address market integrity or financial stability concerns. The competent authority is obliged to communicate the approved modified white paper to relevant entities, including the ESMA, within two working days, and the ESMA will promptly include it in its register.

3. E-Money Tokens

- For e-money tokens, any material mistake, notable new factor or substantial inaccuracy that could affect the assessment of the e-money token must be incorporated into a modified crypto assets white paper. As the above, these issues must be notified to the competent authorities and shared on the issuers' websites.

The MiCAR also outlines specific content requirements for different types of crypto assets. For instance:

- Asset-referenced token white papers must include detailed information about the reserve of assets and the issuer’s governance arrangements, and cannot contain assertions about the future value of the token.

- E-money token white papers must contain a clear warning that the e-money is not covered by investor compensation or deposit guarantee schemes.

Regarding crypto assets other than asset-referenced tokens or e-money tokens, the accompanying white paper must feature the following declaration on its initial page:

"This white paper for the crypto-asset has not undergone approval by any regulatory authority within any EU Member State. The individual or entity offering the crypto-asset is fully responsible for the content provided in this white paper".

Similarly, the white paper should outline the crypto assets's project details as part of the required content. To be specific, the white paper must include an additional unambiguous statement indicating that the crypto-asset:

- Could experience partial or complete loss of value

- Might not be transferable in all cases

- May lack liquidity

- Is not protected by investor compensation or deposit guarantee schemes.

Importantly, the regulation introduces civil liability for incomplete, unfair, ambiguous or misleading information provided in white papers. This liability extends to marketing communications related to the white paper, emphasizing the importance of accuracy and transparency in all investor-facing materials.

In conclusion, the MiCAR sets out rigorous requirements for crypto assets white papers, aiming to promote investor protection, transparency and market integrity in the rapidly evolving crypto assets landscape. By establishing minimum standards for white papers, the regulation aims to enhance the credibility and reliability of crypto assets, fostering trust and confidence among investors and stakeholders.

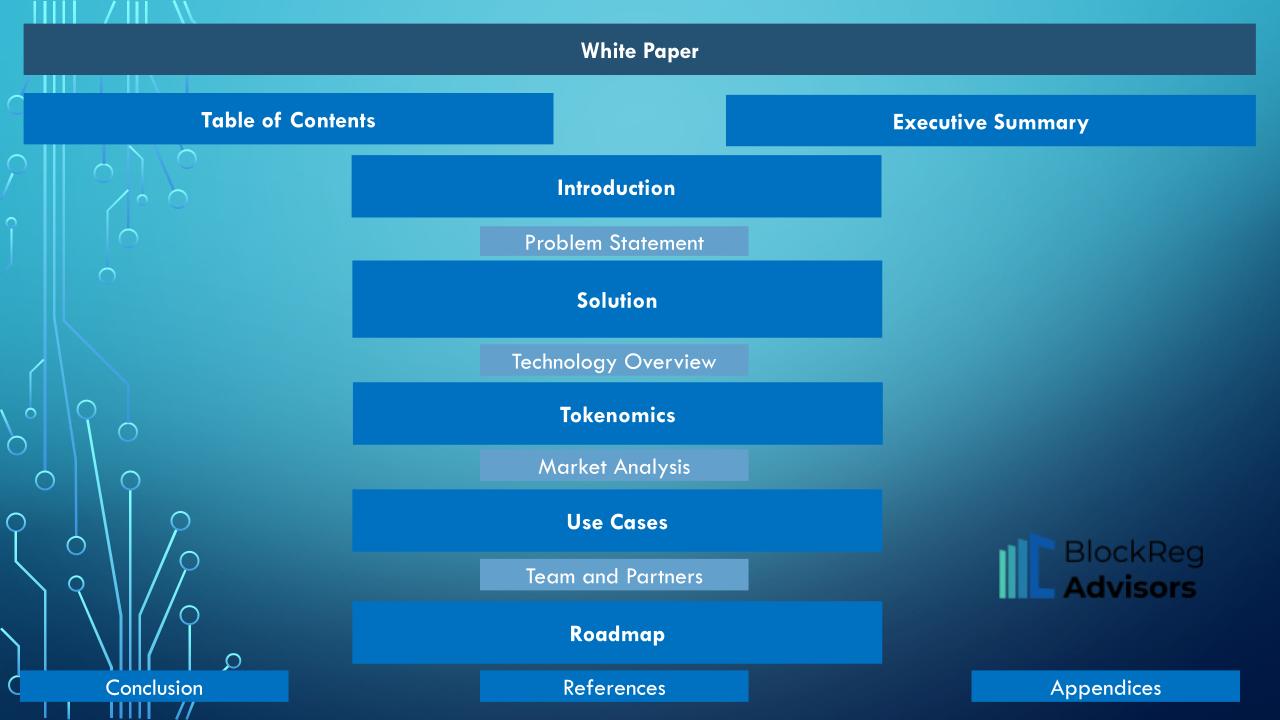

How to Write and Format a White Paper

- Understand Your Audience: Before you start writing, it's crucial to understand your target audience. Tailor your language and content to resonate with your readers.

- Research and Outline: Conduct thorough research on the problem, solution, technology and market landscape. Use this research to create an outline for your white paper.

- Problem Statement: Begin your white paper by clearly defining the problem your project aims to solve. Use real-world examples and statistics to highlight the severity of the issue.

- Solution: Present your project's solution to the problem. Explain how your technology or platform addresses the issue effectively.

- Technology Overview: Dive into the technical details of your project. Explain the architecture, consensus mechanism, smart contract functionality, and any unique features of your technology.

- Tokenomics: If your project involves a cryptocurrency or token, detail the tokenomics. Discuss the token's utility, distribution and any token-related economic models.

- Roadmap and Timeline: Provide a roadmap outlining the development milestones and future plans for your project. This helps investors understand the project's long-term vision and growth trajectory.

- Team and Partners: Introduce your project's team members and key partners. Highlight their expertise and experience in relevant fields.

- Conclusion and Call to Action: Summarize the key points of your white paper and encourage readers to take action, such as investing or joining your project.

- Formatting and Design: Pay attention to formatting and design. Use clear headings, bullet points and visual elements to make your white paper easy to read and visually appealing.

Seeking Assistance in Writing a White Paper?

If you're looking for expert guidance in writing a white paper for your crypto project, consider seeking assistance from a reputable regulatory consulting firm like BlockReg Advisors. BlockReg Advisors specialize in navigating the complex regulatory landscape of the crypto industry and can provide valuable insights and support throughout the white paper writing process.

In conclusion, white papers are vital documents that play a significant role in the success of a business project. By understanding the key components and best practices for writing and formatting a white paper, you can create a compelling and informative document that attracts investors, builds trust and drives the success of your project.

For more information contact us at [email protected].